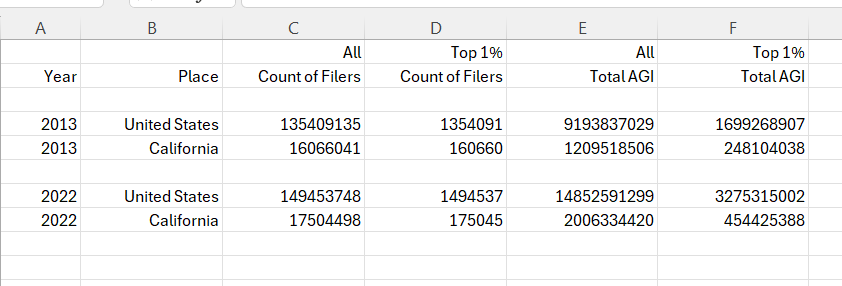

The IRS provides state level data from 2013 to 2022 at this website. Here I reproduce some of the data for California and the entire nation.

Column C reports the count of filers by geography/year. So, California had roughly 16 million tax filers in 2013 and 17.5 million in 2022. In 2013, 11.8% of the nation’s filers lived in California. In 2022, 11.7% of filers lived in California. My state is building less housing than other states. Column D is just the count of filers in the top 1% of the Adjusted Gross Income (AGI) distribution so this column should equal .01 times the count in Column C. Column E presents the total nominal $ AGI. So, in 2013; California’s filers earned 13.2% of the nation’s income and in 2022, California’s filers earned 13.5% of the nation’s income. So, there was a slight increase in California’s overall share of the tax revenue base even though California’s share of national filers decreased. Now, let’s turn to Column F. This column focuses on the total AGI (income earned) by the top 1% of filers. In 2013, California’s top 1% of filers earned 20.4% of California’s total AGI and 2.7% of the nation’s total AGI. In 2022, California’s top 1% of filers earned 22.6% of California total AGI and 3% of the nation’s AGI. Finally, in California; in 2013; the top 1% earned 14.6% of the state’s total AGI but in 2022 this had shrank to 13.9%.

Overall for the top 1% of filers, nation nominal AGI grew by 92.9% from 2013 to 2022 while California’s total AGI for the top 1% of filers grew by 83%. Looking at trends in Column E, national AGI grew by 61.6% while California’s overall AGI grew by 66.1%.

Finally, taking the nominal values, I calculate the following averages;

In 2013, in the USA the average filer earned $68,000 while in California, the average filer’s AGI was $75,300. The average among the top 1% in the USA was $1.2 million and in California it was $1.54 million

In 2022, in the USA the average filer earned $99,400 while in California, the average filer’s AGI was $114,600. The average among the top 1% in the USA was $2.2 million and in California it was $2.6 million.

These descriptive facts suggest to me that California continues to be home to millions of very successful people. The great amenities of the state encourage many of these individuals to invest their wealth in real estate. The state’s taxes and regulatory environment do play a role in encouraging people to leave. Here are some papers that explore this theme.

Brueckner, Jan K., and David Neumark. "Beaches, sunshine, and public sector pay: theory and evidence on amenities and rent extraction by government workers." American Economic Journal: Economic Policy 6, no. 2 (2014): 198-230.

Moretti, Enrico, and Daniel J. Wilson. "Taxing billionaires: Estate taxes and the geographical location of the ultra-wealthy." American Economic Journal: Economic Policy 15, no. 2 (2023): 424-466.

Moretti, Enrico, and Daniel J. Wilson. "The effect of state taxes on the geographical location of top earners: Evidence from star scientists." American economic review 107, no. 7 (2017): 1858-1903.

While a case can be made that in the greater Silicon Valley area that the earnings of the top 1% are due to a treatment effect, most people in California live in the Southern Region and in Southern California, the high earners are selecting to live there. Our region attracts successful people it doesn’t play an important role in causing great wealth. LeBron James and Luka were doing great before they moved to LA to join our top 1%!

Thought-provoking piece, but I’d caution against drawing firm conclusions from aggregate income data alone. While California’s share of national taxable income appears stable, that top-line figure may obscure important shifts beneath the surface. Has the state grown more reliant on top earners while middle- and lower-income residents quietly exit? Without deeper analysis of income brackets and migration patterns by income level, it’s hard to assess the full “treatment effect” of California’s policies. Still, this is an insightful contribution to the conversation — one that opens the door for a more detailed look under the hood.

The goal seems to be a gigantic gated community with an obnoxious Homeowners

association. :)