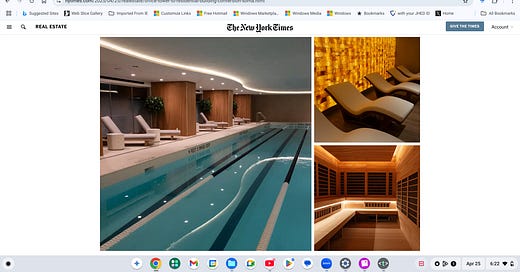

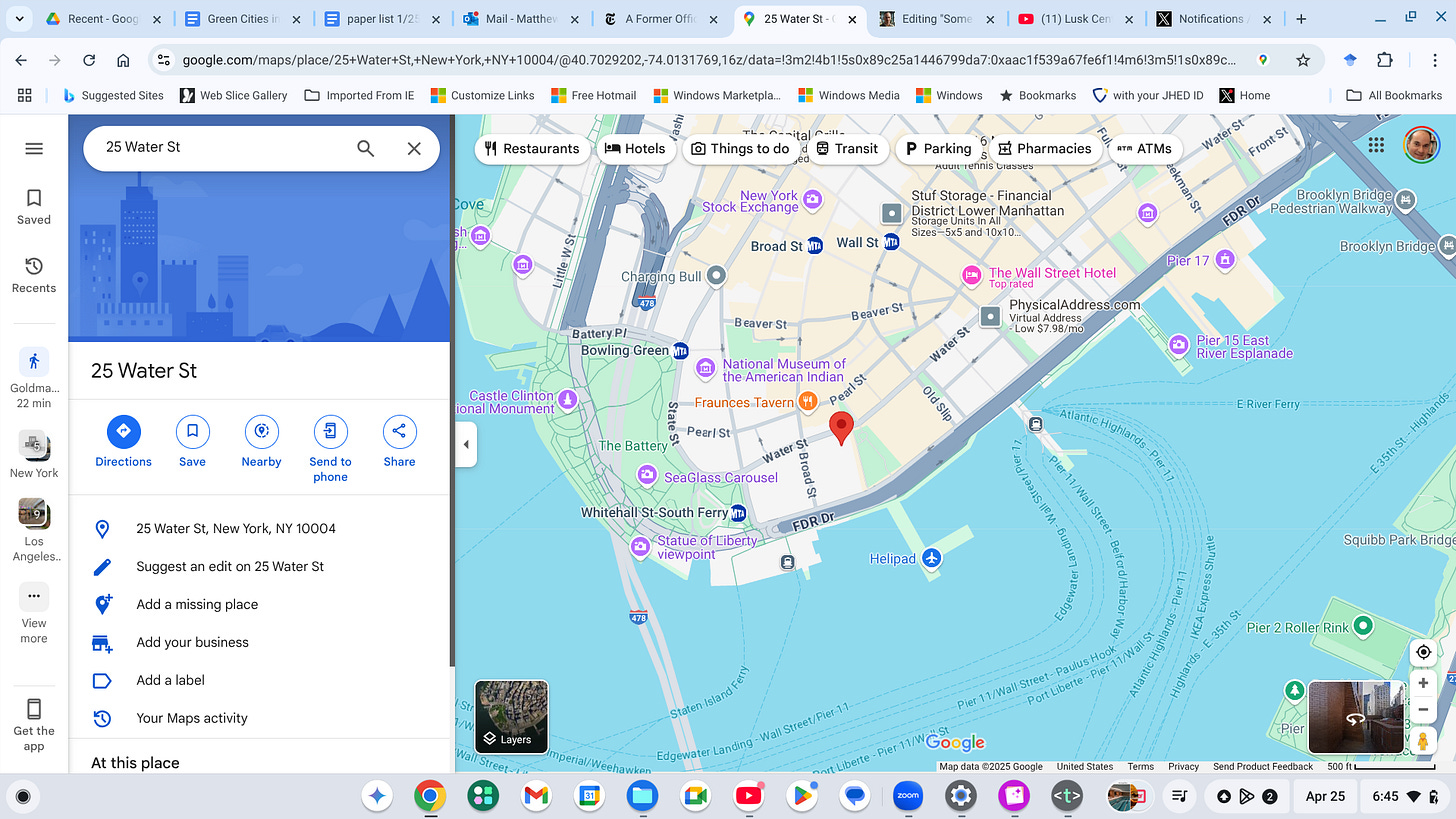

The New York Times has published a great piece about the conversion of an old Wall Street Office building into roughly 1300 new apartments. Social justice advocates will note that 25% of them have been set aside as affordable housing. I will return to this point below. The building has sleek amenities and offers a type of private oasis in the middle of an old, hectic, crowded city. Here is the building’s tempting web page. The building is located at 25 Water Street very close to the Ferry Station at the South East tip of Manhattan in the Financial District.

Some Thoughts

#1 The conversion of older commercial buildings into new residential housing has general equilibrium effects as this “arbitrage” leads to the price of commercial real estate converging to equal the price of residential real estate.

#2 The demand for expensive residential apartments in an office building area depends on local quality of life. If crime is low and if there are good shopping opportunities nearby, then demand for these apartments will be higher. This revitalized building is close to Battery Park. If Battery Park is an amenity, then this increases demand to live in the SOMA building.

#3 Some Wall Street workers want to have a physical separation between where they live and work. Goldman Sachs is a 23 minute walk from this apartment building. Some say that the Financial District is too quiet at night. Will buildings such as SOMA attract enough $ so that good restaurants and night life pop up close by? SOMA has easy subway access to Brooklyn and a short subway ride to the Village. Is this good enough for accessing NYC excitement?

#4 The building has set aside 25% of its units as affordable housing. Let’s do some algebra here. Suppose that a 2 bedroom market rate apartment rents for $6,000 a month and an affordable housing unit rents for $2,000 a month. This means that the owner of the building is losing $4k*12 or $48 grand per unit per year on these apartments. The building has 1300 units so if 25% are “affordable”, then there are 325 affordable units for which the owner is losing $325*48k per year = $15.6 million dollars per year in foregone rent. That is a pretty serious price for gaining the approval of the City to proceed. Where did the number 25% come from? Has this “tax” inhibited other investors from converting other commercial buildings?

#5 The New York Times piece does a great job sketching out the design challenges that the architects faced in redesigning the building. There is “Learning by Doing” here. The next buildings will be easier to convert as skill is being built up and specialization takes place.

#6 The owners of commercial real estate in different parts of NYC will see that they now hold a real option to convert their buildings to Residential. They can start to make certain investments to make this conversion easier to implement.

#7 Will enough children move into SOMA and other new refurbished buildings such that new schools nearby will be needed? Does the City’s land use plans allow for such flexibility? How will the local service economy reconfigure itself? Wall Street used to be a lunch time place. Now it will be more of a 24 hour day buzzing place. Will there be private security operating to keep Street safety?

#8 The creation of a new residential neighborhood in an old city offers many lessons. The geography of the SOMA area is a bit weird because it is close to the River

The isolation of the Red Pin you see in the map does reduce the demand to live there because this isn’t a central point. What will will the owners of the building do to overcome their geographic isolation challenge? The New York Times emphasizes that the complex is a type of Xanadu with all sorts of amenities for every age group.

#9 Finally, let’s return again to the 25% of the occupants of the building who win the lottery and are offered the highly subsidized units in the building. Will their children interact with the rich children in the building? Will there be a “poor door” in the building? Or will the owners of the building create the space to encourage the interaction of all of the neighbors in the building? A sociologist could write a good future book about social interactions at the SOMA. Does physical proximity cause social interactions across income groups?

Many cities have been using low-income set asides for decades now, we should not have to wait to see what the experiences with societal blending experiments are. What works, and what does not? Why? Not just in theory, but reality.

I live in a large high-income building and interaction of the residents is relatively rare as most are working and their jobs are intense and the hours long. Purely social interaction is a luxury for these high achievers. My acquiantances in similar buildings and their experiences over many years also report that interaction is rare but gracious. Those with less demanding jobs, or where they work closer to an 8 hour day, may find the high income people stand-offish. They may be, or it could just be the high income/high work intensity crowd do not socialize much outside of work oriented needs.

If there is minimal interaction, is the entire concept of having a low income set aside meritless, or even detrimental to society given the costs to society to subsidize people to live in luxury buildings?

In some of these circumstances, a person who is just starting a career my qualify for a low-income set asied may, within a few years, become a lavishly paid i-banker, lawyer or surgeon. Then what happens, do you continue to subsize someone who is now in the top, not just 1%, but 0.01%?

Disclaimer: I am an Austrian school of economics sort of guy. Think Milton Friedman. Subsidies to us are unwarranted market distortions that lead to nearly always adverse outcomes for society as a whole.