The Adaptation Benefits of Home Owners Obtaining Their Mortgage Loan and Insurance From the Same Firm

Too much climate economics focuses on estimating short run “causal effects” of the impact of X on Y. Every week, a new paper grabs the headlines as it definitively demonstrates that weather extremes cause some nasty outcome. The mechanisms sections of these papers (the “Why”) tend to be short and speculative.

As an older scholar, I know that I can always publish here! My friends have heard me say many times that what is missing from the “cause and effect” one equation climate economics literature is a subtle discussion of the contracts and incentives of firms. This column offers one concrete example.

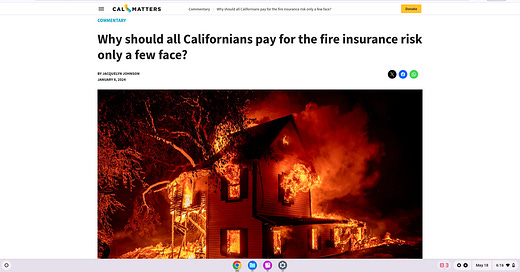

In 2024, many American home owners own older homes that turn out that they are in flood and fire zones and insurers are trying to raise insurance premiums for these homes and home owners are crying out seeking state regulators to step in and regulate price ceilings. The incumbent home owners want a “free lunch” of access to cheap insurance. They want all other Americans including renters and those who made better bets to subsidize them. Such property owners want to flip 1 sided coins such that they keep the capital gains if the local market booms and they want to nationalize new unexpected costs such as higher insurance prices. Home owners are adults and they live with the consequences of their bets. Those who bet on safer properties gain an asset appreciation as demand for their properties will rise.

Efforts to obtain subsidies is bad capitalism but represents a good political effort! Moral Hazard introduced by such spatial subsidies makes economists nuts but it gives us fodder to teach our bored undergraduates.

Here is a piece I like about the core issue of spatial $ transfers. My ideas below regarding contractual redesign solve this problem.

John Lennon and Yoko Ono wrote their song “Imagine”. I want to change the lyrics;

Imagine if Lina Khan permitted the merger of lending banks and insurance companies. I claim that this new contract design would sharply help the real estate sector to adapt to climate change.

Several synergistic adaptation benefits emerge from this merger.

The Lender’s Perspective

Banks that make 30 year loans to borrowers are brave. The banker says; “Home buyer, here is X dollars. You must pay our bank this principal plus interest over the next 30 years. If you fail to pay this, we will take your house.”

In an economy facing unknown climate risks and a whole range of other shocks to the home’s geography, this is an open ended bet. The bank is also betting on the borrower. Will she continue to be solvent? What is her health? What is her household’s finances and employment prospects likely to be? Home buyers aren’t randomly assigned to homes. Did the risky buyer (in terms of default risk) choose to live in a risky home? What extra synergistic risk emerge from such self-selection?

If the loan lender could coordinate with the insurer then the insurer could offer property specific tailored terms that encourage the home buyer to invest in property precautions that reduce flood and fire risk. Cheap drone flyovers could verify this. The insurer could even cover health and local unemployment rate events to reduce income risk without introducing moral hazard.

The integrated team would face less default risk.

Now a clever point —- In the face of regulatory price ceilings on insurance rates; the integrated lender/insurer could set the price of insurance at the regulatory cap for risky properties and charge a higher interest rate on the mortgage. The home buyer would face a choice of a cheaper mortgage and no insurance or buying this bundle from the integrated seller. (I recognize that the home owner would prefer to buy the State’s subsidized insurance but that product will no longer be around in the near future).

The point I want you to think about is that the integration between the lender and the insurer leads to a safer asset and this is especially valuable if the home’s physical location faces greater fire or flood risk. How does this occur?

The insurer can use non-linear contracts to incentivize the asset owner to invest in precautions such as clearing shrubs and elevating the structure and using sand bags and this reduces the probability that home owner defaults on the loan when extreme weather events occur. If the merged entity didn’t exist then the insurer ignores how its actions affects mortgage loan default probabilities.

This is similar to a firm that sells lamps and light bulbs.

An Empirical Prediction ; Suppose that America features Z different homes and 10% of them at a point in time feature owners who have a loan and a mortgage from the same integrated firm. Call this 10% subset “the treated” homes.

A Data Scientist would wait for natural experiments to occur such as terrible fires and floods.

The empirical test that this new contractual regime that allows for this merger of insurers and lenders fuels climate change adaptation is if we observe that the “treated homes” (the 10%) suffer less damage per home than the 90% of homes located in the same shocked areas whose mortgage and insurance are supplied by separate firms.

Wrapping Up

The causal effects climate economists estimate their short run damage functions. If such research highlights that we are suffering under the status-quo policies, then capitalism starts to shift and experiments such as the one proposed in this column are tried. I claim that damage resulting from future equally severe physical shocks would be lower under my proposed “rules of the game”. This column highlights why I am so optimistic about our ability to adapt to climate change.

My 2021 Book expands on these themes.

Update

I have written this piece assuming that no new housing is ever built. But, suppose that the integrated lender/insurers take over their markets. This will push more housing construction to “higher ground” because interest rates and insurance rates will be cheaper there because that land is less risky in an age of climate change.

As I discuss in my 2021 book, we need to reward local governments in such climate safe areas to “up zone” in order to build more housing in such places? So, the insurance industry (without government subsidies) can play a central role in pushing our economy to physical locations where we face less physical risk from climate change. Once, we select these locations property owners then invest to protect their properties and they have the right incentives to compare their own benefits and costs. As their demand for physical risk reduction strategies rise, entrepreneurs will deliver new strategies and this will further increase resilience investment.