The Economic Implications of Transforming Some Federal Land into New Exurban Housing

Supply and Demand!

The Federal Government owns and manages 28% of the land area of the United States. The Trump Administration is exploring whether to allocate some of this land to build new suburban communities. I want to discuss some basic economic ideas here. First some, background.

The New York Times recent piece;

As I started to sketch out my thoughts, I found this wonderful Substack column by Nolan Gray that he published in December 2024. Nolan gets specific and pinpoints parcels of land and creates great maps to show where development could take place.

Here is a quote from Nolan.

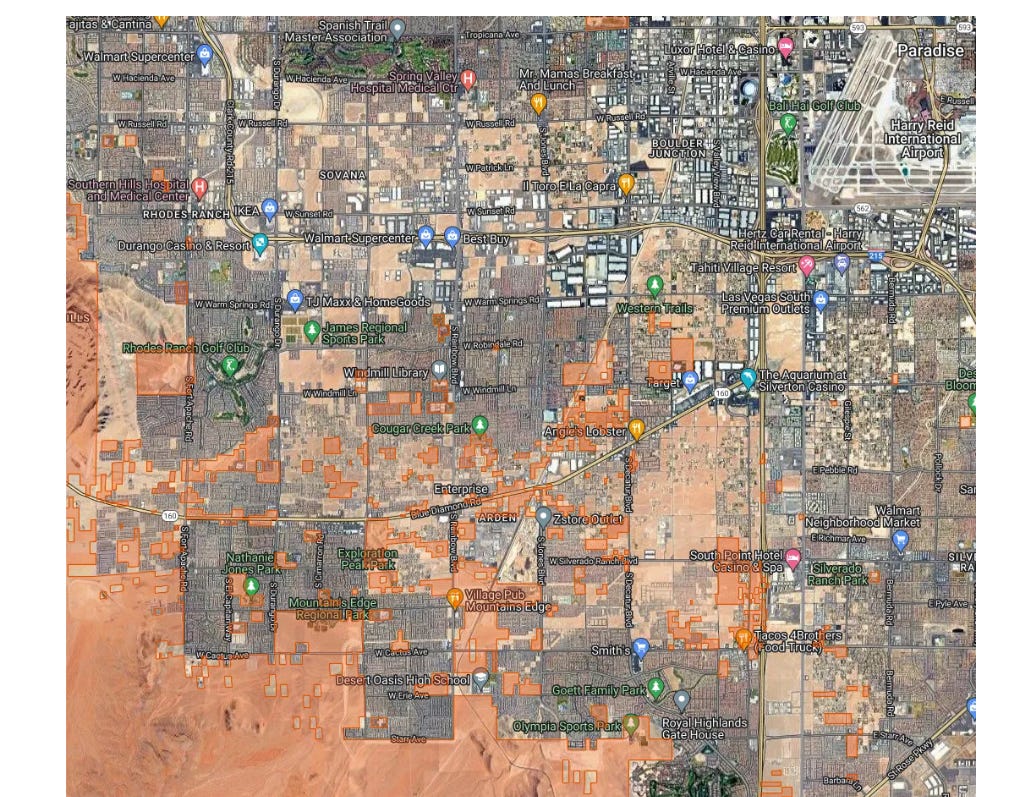

Here is his map of Las Vegas showing the Southern area where BLM land could be sold off. Note Harry Reid Airport in the Upper-Right part of the map

My New Points

#1 The rise of hybrid/WFH increases demand for such housing as these workers only commute to work two or three times a week and thus they can literally “head for the hills” at lower total weekly commuting costs. I discuss this point in this 2022 Business Insider piece.

#2 If enough people move to these new communities, these could be U.S Charter Cities as these new communities can learn from Paul Romer’s blueprint of starting out with new rules that price roads and use market price signals to design a well governed community. I predict that there would be experimentation with schooling methods that are not captured by public sector unions because there would be no incumbent unions. Such new communities would adopt their own rules for governing the area and these small labs would allow for different ways to educate children, and police the area and clean up the trash to be tried. These small experiments offer valuable lessons for the rest of the nation.

#3 Airports tend to be at the fringe. Some of the new Fringe housing on Federal Land would have a short commute time to the airport. This would attract those who have to do a lot of flying.

#4 Water and Sewage providers often talk about the costs of sprawl of extending infrastructure far out. To reduce the costs of delivering power, and delivering clean water and processing dirty water, new decentralized methods would be experimented with and new lessons would be learned. Ideas are public goods!!

#5 While the land would be cheap, how costly would the construction be with site built housing? Wes Miller and I are writing a new paper on the benefits of areas zoning to permit manufactured housing to be built. Such a housing is cheaper to produce and would unleash new American Manufacturing jobs.

#6 Suppose these new homes are purchased using a Housing Partnership rather than solely relying on debt financing. In this case, a recent homebuyer might own 50% of the home she occupies while a large investor owns the other 50%. More middle class people would become homeowners while still holding a diversified portfolio. Jan Brueckner, Joe Tracy and I are now working on this issue.

#7 These exurban new communities represent a credible threat for nearby Center Cities. If these Center Cities offer low quality of life per tax $, then there will be more flight to these areas. Spatial competition nudges inefficient Blue Cities to improve their urban governance! Read my new 2025 book; Free to Choose in the American City.

#8 Political Economy issues arise. Incumbent property owners in areas close to the BLM public lands will launch lawsuits to block this privatization of public land. Which judges have jurisdiction here? Will the Coase Theorem’s optimism hold here? Who has the property rights in determining what land can be reallocated?

#9 I am well aware that some of the land that Nolan points out above is located in very hot places. Those who choose to live and buy in such areas will know what local challenges await them. I am an adaptation optimist. If enough individuals move to these areas, then this stimulates endogenous innovation for addressing these issues!

Unfortunately the federal land is not where people are most willing to pay to live. Plus his planned trillion dollar a year deficit increase wil mean higher real interest rates for developers.